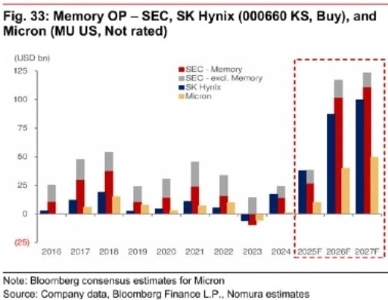

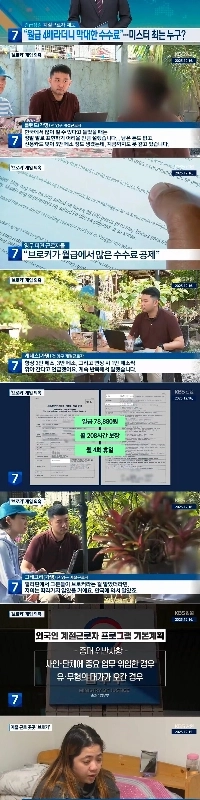

Past financial crises are haunting South Korean policy makers as they rush to support a local credit market that’s quickly gone from one of the world’s safest to teetering on the brink As Korea gets swept into a global debt market rout corporate treasurers and market regulators in Seoul are staring down one of the most rapid deteriorations in the nation’s credit market ever The rout is one of the worst in Asia’s local-currency markets amid a broader fixed-income slump this year Yields on top-rated five-year Korean corporate debt have spiked 157 basis points in the three months through October the worst such blowout on record One particularly alarming development has been yields surging to a 13-year high on local commercial paper which companies use to raise funds for short-term payments like payrollThe spike in the cost to borrow in that key money market intensified after a shock default in late September when the developer of the Legoland Korea theme park in Gangwon Province to the northeast of Seoul missed payment on a kind of commercial paper repackaging loans The builder’s largest shareholder is Gangwon underscoring fears that in the new global era of rising interest rates even borrowers with government backing are vulnerable The type of financial engineering involved in that case is called project finance asset-backed commercial paper or PF-ABCP as the Korean press shorthands it It’s a key source of funds for the broader property sector The real estate industry as in many countries is already straining under the impact of rising rates amplifying fears that loans tied to construction projects underpinning the PF-ABCP could start souring more ahead There’s a lot at stake with at least 236 trillion won $166 billion of such instruments backed by brokerages or builders set to mature by the end of 2022 according to NICE Investors Service

Crisis Trauma Haunts Korea as It Confronts a Credit Meltdown – Bloomberg

要約

韓国は世界で最も安全なところの一つから信用危機で危険な国家に転落中である現在、最高等級の社債スプレッドまで3ヵ月ぶりに157bp拡大し、甚だしくは給与のような短期性資金調達のために発行される債券の金利まで13年ぶりの最高値まで上昇することは、9月の江原道のレゴランド事態以後、政府支援の借主さえ信用危機に露出して脆弱になりかねないことが明らかになり、急速に悪化する。特に不動産事業において主要資金調達源であるPF-ABCP不良がさらに深刻になりかねないという恐怖が広がっていることと関連して証券会社および建設

この文が政治文だと思われるものはハングルからまた勉強して小学校6年修了して読みに来てください。

政治とは関係なく、本当に恐ろしい状況です。 これからが始まりなんですが